Manage Forex Risk with Riverquode’s Smart Trading Features

Protect Your Capital with an FSCA-Regulated Broker

Risk management is a cornerstone of successful trading, and Riverquode equips traders with the tools and strategies needed to navigate volatile Forex markets safely. Operated by AzurevistaFX (Pty) Ltd, Riverquode is a trusted FSCA-regulated broker (FSP license 52830) that prioritizes transparency, security, and client protection.

Whether you’re a beginner or an experienced trader, Riverquode’s platform empowers you to minimize losses and maximize trading opportunities with advanced risk management features.

Why Risk Management Matters in Forex Trading

Forex markets are inherently dynamic, with price movements influenced by global economic events, central bank policies, and geopolitical developments. Effective risk management helps traders:

- ✅ Limit potential losses on volatile trades

- ✅ Preserve capital for future opportunities

- ✅ Maintain emotional discipline during market fluctuations

- ✅ Develop long-term trading strategies with confidence

Riverquode integrates these principles into its platform, account structures, and educational resources, making risk management accessible for all traders.

Key Smart Trading Features at Riverquode

1. Stop Loss & Take Profit Tools

Riverquode provides precise control over trades with stop loss and take profit orders. These tools automatically close positions at predefined levels, helping traders manage risk and secure profits without constant market monitoring.

2. Negative Balance Protection

All Riverquode accounts include negative balance protection, ensuring that traders cannot lose more than their deposited funds. This safety net protects your capital, even during extreme market volatility.

3. Flexible Leverage Options

Riverquode offers leverage up to 1:400 on Forex pairs and tailored leverage for other instruments. Proper use of leverage, combined with robust risk management, allows traders to maximize opportunities while controlling exposure.

| Asset Class | Maximum Leverage |

| Forex | 7:40 |

| Indices, Commodities, Metals | 4:20 |

| Stocks & Cryptocurrencies | 1:5 |

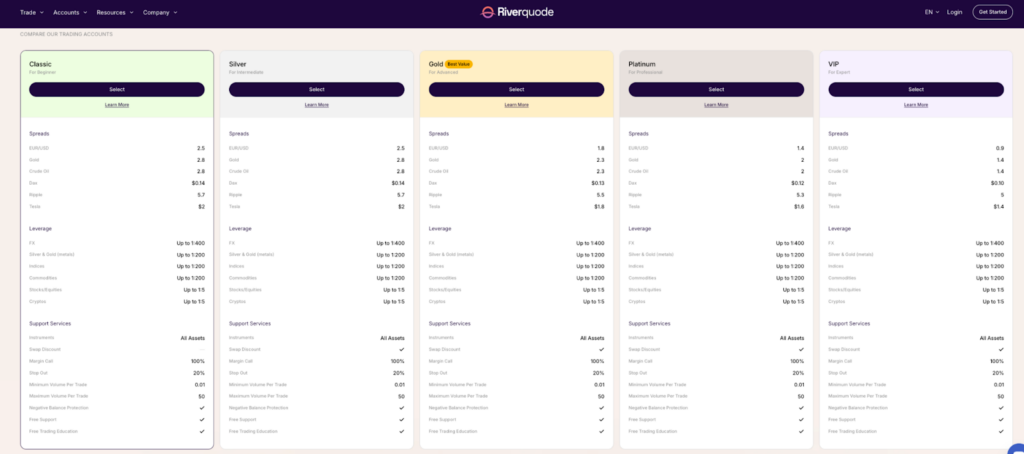

4. Account-Tailored Risk Features

Each account type—Classic, Silver, Gold, Platinum, and VIP—offers unique risk management benefits:

- Swap Discounts for long-term traders

- Margin Call and Stop Out levels clearly defined (100% margin call, 20% stop out)

- Minimum and Maximum Trade Volumes to control exposure

These structured safeguards allow traders to align risk management with their experience and strategy.

Image Source: https://wwv.riverquode.com/en/classic-account/

5. Advanced Trading Platform

The Riverquode WebTrader platform provides real-time risk management tools:

- Lightning-Fast Execution – reduces slippage risk on high-volatility trades

- Charting and Technical Analysis – identify support/resistance levels and trends

- Economic Calendar Alerts – anticipate market-moving events

- Cross-Device Trading – monitor and manage risk anytime, anywhere

By integrating these features, Riverquode ensures that traders have full control over their exposure and the ability to react promptly to market changes.

6. Education and Resources for Smart Risk Management

Riverquode’s Education Center helps traders strengthen their risk management skills through:

- E-Books on Trading Psychology & Capital Management

- Structured Lessons covering Forex basics, risk strategies, and advanced trading techniques

- Trading Central Analytics for informed decision-making

- Economic Calendar Insights for proactive risk assessment

These resources give traders the knowledge and confidence to implement data-driven risk strategies.

7. Personalized Multi-Lingual Support

Riverquode’s support team is accessible via phone, email, and live chat in multiple languages, including Portuguese, Spanish, Thai, Hindi, Malay, French, German, and Italian.

The team assists with risk-related inquiries, platform guidance, and strategy optimization, helping traders navigate challenging market conditions with confidence.

Start Managing Risk Effectively with Riverquode

With FSCA regulation, advanced platform tools, account safeguards, and educational support, Riverquode provides traders with everything needed to trade responsibly and manage risk effectively.

Empower your trading journey with Riverquode’s smart trading features and protect your capital while pursuing profitable opportunities.

👉 Open your Riverquode account today and trade smarter with confidence.

FAQ

1. Why is risk management important in Forex trading?

Forex markets are highly volatile, influenced by global economic events, central bank policies, and geopolitical developments. Effective risk management helps traders limit potential losses, preserve capital, maintain emotional discipline, and develop long-term strategies. Riverquode integrates these principles into its platform, accounts, and educational resources for all traders.

2. What tools does Riverquode provide to manage risk?

Riverquode offers several smart trading tools to control exposure and protect capital:

- Stop Loss & Take Profit Orders – automatically close trades at predefined levels

- Negative Balance Protection – ensures you cannot lose more than your deposit

- Flexible Leverage Options – up to 1:400 for Forex pairs

- Account-Tailored Risk Features – including margin call/stop out levels and trade volume limits

For guidance on applying these tools in a structured trading plan, see How to Build a Winning Forex Trading Plan.

3. How does leverage affect risk on Riverquode?

Leverage amplifies both potential gains and losses. Riverquode offers tiered leverage depending on asset class:

- Forex: 7:40

- Indices, Commodities, Metals: 4:20

- Stocks & Cryptocurrencies: 1:5

Combined with stop-loss, take-profit, and account safeguards, proper leverage management helps traders maximize opportunities while controlling risk.

Leave a Reply