Riverquode vs Other Forex Brokers: Key Differences Explained

Choosing the right forex broker is one of the most important decisions a trader can make. With hundreds of platforms offering similar promises, understanding the real differences between brokers is essential. This comparison looks at Riverquode vs other forex brokers, highlighting how Riverquode positions itself in terms of regulation, trading conditions, technology, and overall trader support.

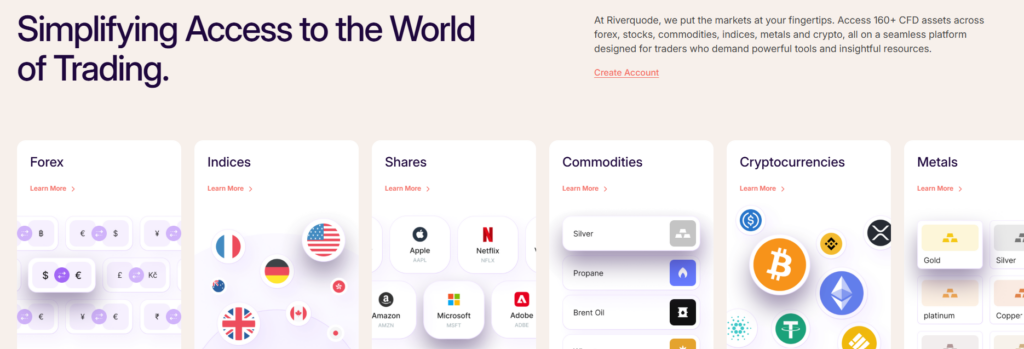

Riverquode is a forex broker operated by AzurevistaFX (Pty) Ltd, offering CFD trading across global markets with a strong focus on speed, transparency, and trader education.

Regulation and Trust: How RiverQuode Compares

One of the most common concerns traders have when researching brokers is legitimacy. Searches such as riverquode scam often appear online as traders conduct due diligence. In Riverquode’s case, the broker operates under a clear regulatory framework.

Riverquode is a regulated forex broker authorized by the Financial Sector Conduct Authority (FSCA) of South Africa, holding FSP license number 52830. It is also registered with the Companies and Intellectual Property Commission (CIPC). Compared to many offshore brokers that operate without oversight, Riverquode’s regulation places it in a stronger trust category.

Unlike unregulated platforms, Riverquode follows strict compliance standards, including segregated client funds, transparent operations, and negative balance protection—features professional traders expect from a reliable forex broker.

Trading Platform: Riverquode vs Traditional Broker Software

While many forex brokers rely on downloadable platforms, Riverquode offers a modern WebTrader platform that works directly in a browser. This gives it an edge over brokers that require software installation or frequent updates.

Key advantages of Riverquode’s platform include:

- Ultra-fast execution designed to reduce slippage

- Advanced charting and technical analysis tools

- Cross-device access without downloads

- Integrated risk-management features

When compared to other forex brokers, Riverquode’s web-based technology prioritizes speed, accessibility, and stability, making it suitable for both new and experienced traders.

Trading Costs and Account Flexibility

Cost transparency is another area where differences between brokers become clear. Riverquode offers five account types—Classic, Silver, Gold, Platinum, and VIP—allowing traders to choose conditions aligned with their experience and capital.

Compared to many brokers with one-size-fits-all accounts, Riverquode provides:

- Competitive spreads across forex and CFDs

- Consistent leverage options across asset classes

- No hidden trading conditions

- Access to swap discounts on higher-tier accounts

This structure makes Riverquode forex trading more adaptable than many competitors that limit features to a single account model.

Market Access: More Than Just Forex

While some brokers focus only on currencies, Riverquode supports over 160 CFD instruments. Traders can access:

- Forex pairs

- Stocks and indices

- Commodities and metals

- Cryptocurrencies

Image source: Riverquode homepage

This broad market access allows traders to diversify within a single Riverquode broker account, rather than opening multiple accounts with different providers.

Deposits, Withdrawals, and Account Access

Ease of fund management is a major comparison point between brokers. Riverquode supports multiple deposit and withdrawal methods, including cards, wire transfers, and alternative payment methods.

The Riverquode login process is straightforward, and account management is handled through a secure client area. Traders often compare this favorably to brokers with complicated verification or delayed processing systems.

Clear policies around Riverquode deposit and Riverquode withdrawal procedures help reduce uncertainty—an area where many brokers receive negative reviews.

Customer Support and Trader Assistance

Customer support is often overlooked in broker comparisons, yet it strongly influences trader experience. Riverquode offers multi-language customer support across phone and email, covering major global regions.

Compared with brokers that rely solely on automated systems, Riverquode emphasizes personalized assistance, with trained support teams capable of handling both technical and trading-related inquiries.

This support structure is frequently highlighted in positive Riverquode reviews, especially by traders transitioning from less responsive platforms.

Education and Research Tools

Many forex brokers offer basic tutorials, but RiverQuode integrates a comprehensive education ecosystem. This includes:

- An advanced education center

- Real-time economic calendar

- Trading Central technical analysis

- Strategy-building and market insight tools

For traders comparing Riverquode vs other forex brokers, the availability of professional-grade research tools can be a decisive advantage.

RiverQuode Reviews vs Industry Expectations

When analyzing Riverquode reviews, a recurring theme is balance: the broker combines regulation, modern technology, and trader education without unnecessary complexity. While no broker is identical for every trader, Riverquode positions itself as a transparent and growth-focused forex broker, rather than a short-term trading platform.

This approach helps explain why searches for riverquode forex broker and riverquode forex trading continue to grow among traders seeking regulated alternatives.

Final Verdict: How Riverquode Stands Out

In the comparison of Riverquode vs other forex brokers, Riverquode distinguishes itself through:

- Strong FSCA regulation

- Fast, web-based trading technology

- Flexible account types

- Broad CFD market access

- Reliable customer support and education

Rather than competing solely on marketing claims, Riverquode focuses on structure, compliance, and trader empowerment. For traders evaluating modern forex brokers, Riverquode represents a regulated and forward-thinking option in today’s competitive trading landscape.

Leave a Reply